MonaVale Crypto has emerged as a prominent player in the ever-evolving landscape of cryptocurrencies. As an introductory step, it’s essential to provide readers with a comprehensive overview of MonaVale Crypto, including its origin, purpose, and significance within the cryptocurrency market. By understanding MonaVale’s unique features and its position in the crypto ecosystem, readers can gain insights into why it’s worth exploring further.

Historical Performance

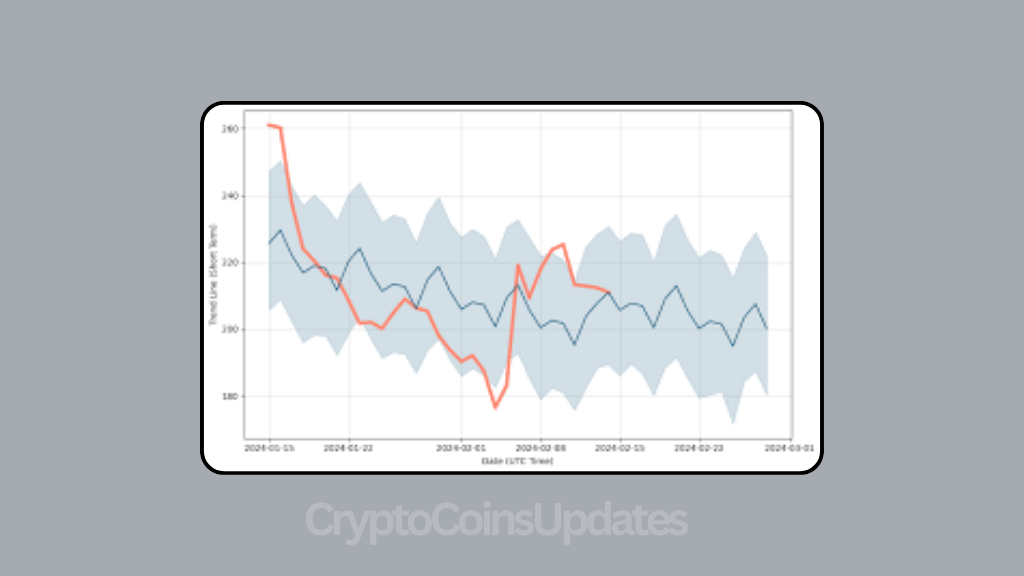

To grasp the current state of MonaVale Crypto, it’s crucial to delve into its historical performance. Analyzing past price movements, trends, and market behavior can offer valuable insights into its price dynamics and potential future trajectory. By examining historical data, we can identify patterns, cycles, and key factors influencing MonaVale’s price over time, providing a foundational understanding for further analysis.

Market Analysis

A comprehensive market analysis is essential for assessing MonaVale Crypto’s current standing. This involves examining broader cryptocurrency market trends, including market sentiment, trading volume, and overall market conditions. By contextualizing MonaVale within the broader market landscape, readers can better understand how external factors may influence its price movements.

Technical Analysis

Technical analysis plays a pivotal role in forecasting future price movements of MonaVale Crypto. By utilizing various technical indicators, chart patterns, and statistical tools, we can identify potential entry and exit points, support and resistance levels, and trend directions. Through technical analysis, readers can gain insights into potential buying or selling opportunities and better navigate the volatile cryptocurrency market.

Fundamental Analysis

Fundamental analysis involves assessing MonaVale Crypto’s intrinsic value based on its underlying technology, team, partnerships, and adoption. By conducting a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), readers can evaluate MonaVale’s fundamentals and determine its long-term viability and growth potential. Fundamental analysis complements technical analysis by providing a deeper understanding of MonaVale’s underlying value drivers.

Price Prediction Models

Various price prediction models, including machine learning algorithms, regression analysis, and sentiment analysis, are employed to forecast MonaVale Crypto’s future price movements. These models utilize historical data, market trends, and other relevant factors to generate predictions. By exploring different prediction methodologies and their strengths and limitations, readers can assess the reliability of price forecasts and make informed investment decisions.

Expert Opinions

Gathering insights and predictions from cryptocurrency experts and analysts provides valuable perspectives on MonaVale Crypto’s future price trajectory. By examining differing viewpoints and expert opinions, readers can gain a broader understanding of potential scenarios and outcomes. Expert opinions offer valuable insights into market sentiment, trends, and emerging developments, helping readers make informed decisions.

Community Sentiment

Community sentiment plays a significant role in shaping MonaVale Crypto’s price dynamics. By monitoring social media, forums, and online discussions, readers can gauge the sentiment of the cryptocurrency community towards MonaVale. Positive sentiment may indicate bullish market sentiment and vice versa. Understanding community sentiment can provide valuable insights into potential price movements and market trends.

News and Events

Recent news, developments, and events related to MonaVale Crypto can have a significant impact on its price. By reviewing recent announcements, partnerships, regulatory developments, and other relevant events, readers can assess their potential implications on MonaVale’s price trajectory. Analyzing the correlation between significant news and price movements can help readers anticipate future market trends.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies can influence MonaVale Crypto’s price outlook. By examining regulatory developments, compliance requirements, and potential regulatory risks, readers can assess the impact of regulations on MonaVale’s market performance. Understanding the regulatory landscape is crucial for evaluating MonaVale’s long-term sustainability and growth prospects.

Market Volatility

The cryptocurrency market is inherently volatile, and MonaVale Crypto is no exception. By discussing market volatility and its impact on MonaVale’s price stability, readers can understand the challenges and opportunities associated with investing in cryptocurrencies. Strategies to mitigate risk in volatile market conditions, such as diversification and risk management techniques, can help readers navigate market fluctuations effectively.

Investment Strategies

Providing guidance on investment strategies tailored to MonaVale Crypto’s unique characteristics is essential for readers looking to invest in the cryptocurrency. By discussing considerations such as risk tolerance, investment horizon, and financial goals, readers can develop personalized investment strategies. Topics such as dollar-cost averaging, diversification, and long-term hodling are explored to help readers make informed investment decisions.

Price Targets and Scenarios

Setting price targets and outlining potential bullish and bearish scenarios for MonaVale Crypto based on the analysis conducted provides readers with actionable insights. By identifying key support and resistance levels and outlining possible price trajectories, readers can better anticipate MonaVale’s future price movements and adjust their investment strategies accordingly.

Conclusion

In conclusion, synthesizing the key findings of the analysis and providing a final assessment of MonaVale Crypto’s price prediction offers readers a concise summary. Encouraging readers to conduct their own research and exercise caution when investing in cryptocurrencies reinforces the importance of conducting due diligence and making informed decisions. While MonaVale Crypto presents intriguing opportunities, it’s essential to approach investment with caution and awareness of the inherent risks associated with cryptocurrency trading.

FAQs

What is MonaVale Crypto?

MonaVale Crypto is a decentralized digital currency that operates on a blockchain network. It aims to provide users with fast, secure, and low-cost transactions while maintaining decentralization and privacy.

How can I purchase MonaVale Crypto?

MonaVale Crypto can typically be purchased on various cryptocurrency exchanges by trading it for other digital assets such as Bitcoin or Ethereum. Users can create an account on a supported exchange, deposit funds, and place buy orders for MonaVale Crypto.

What factors influence the price of MonaVale Crypto?

The price of MonaVale Crypto is influenced by various factors, including market demand, supply dynamics, investor sentiment, regulatory developments, technological advancements, and macroeconomic trends. Fluctuations in these factors can impact MonaVale’s price volatility.

Is investing in MonaVale Crypto risky?

Like all cryptocurrencies, investing in MonaVale Crypto carries inherent risks due to market volatility, regulatory uncertainty, technological vulnerabilities, and other factors. Investors should conduct thorough research, assess their risk tolerance, and diversify their investment portfolios accordingly.

Can I mine MonaVale Crypto?

MonaVale Crypto may utilize a consensus mechanism that allows for mining, depending on its underlying blockchain protocol. Miners typically contribute computing power to secure the network, validate transactions, and earn rewards in the form of newly minted MonaVale tokens and transaction fees.

How can I store MonaVale Crypto securely?

MonaVale Crypto can be stored in cryptocurrency wallets, including hardware wallets, software wallets, and paper wallets. Hardware wallets offer offline storage and are considered one of the most secure options, while software wallets provide convenience but may be vulnerable to hacking.

Is MonaVale Crypto legal?

The legality of MonaVale Crypto depends on the regulatory framework in the jurisdiction where it is used or traded. Cryptocurrency regulations vary by country, and users should comply with relevant laws and regulations governing the use and exchange of digital assets.

Can I use MonaVale Crypto for transactions?

Depending on its adoption and integration with merchants and payment processors, MonaVale Crypto may be used for transactions, including online purchases, remittances, and peer-to-peer transfers. Users should verify the acceptance of MonaVale as a payment method by merchants before transacting.

What are the long-term prospects of MonaVale Crypto?

Predicting the long-term prospects of MonaVale Crypto involves assessing its technology, adoption, competition, regulatory landscape, and market demand. While MonaVale may have potential for growth, investors should consider both opportunities and risks when evaluating its long-term outlook.

Where can I find reliable information about MonaVale Crypto?

Reliable information about MonaVale Crypto can be found on its official website, whitepaper, social media channels, cryptocurrency forums, news websites, and reputable cryptocurrency publications. It’s essential to verify information from multiple sources and exercise discernment when conducting research.

These FAQs address common inquiries about MonaVale Crypto, providing readers with valuable insights into its nature, usage, risks, and potential rewards. By addressing these questions, readers can develop a better understanding of MonaVale Crypto and make informed decisions regarding its utilization and investment.