Introduction to Iron Condor Trading Strategy

Definition and Overview

An iron condor is a popular options trading strategy that involves the simultaneous sale of an out-of-the-money call spread and an out-of-the-money put spread. It’s designed to generate profit when the underlying asset remains within a specific price range.

Brief History and Evolution

The iron condor strategy gained popularity among options traders in the late 20th century as a means to capitalize on sideways or range-bound markets. Its evolution stems from the need to mitigate risk while still maintaining the potential for profit.

Importance and Benefits

This strategy offers several benefits, including limited risk, high probability of profit, and the ability to profit from neutral market conditions. It’s favored by traders seeking consistent returns with controlled risk exposure.

Understanding Options Trading

Basics of Options Contracts

Options contracts provide the holder with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) within a specified period (expiration date).

Call and Put Options

Call options give the holder the right to buy the underlying asset at the strike price, while put options give the holder the right to sell the underlying asset at the strike price.

Option Premiums and Pricing

The price of an options contract, known as the premium, is determined by factors such as the underlying asset’s price, volatility, time until expiration, and interest rates.

Introduction to SPY

Overview of SPY (SPDR S&P 500 ETF)

SPY is an exchange-traded fund that tracks the performance of the S&P 500 index, making it a popular choice for options trading due to its liquidity and diversification.

Significance in Options Trading

SPY options are among the most actively traded options contracts, providing traders with ample liquidity and opportunities for executing various strategies, including the iron condor.

Historical Performance

Historical data on SPY’s price movements and volatility can help options traders make informed decisions when implementing the iron condor strategy.

Iron Condor Strategy Explained

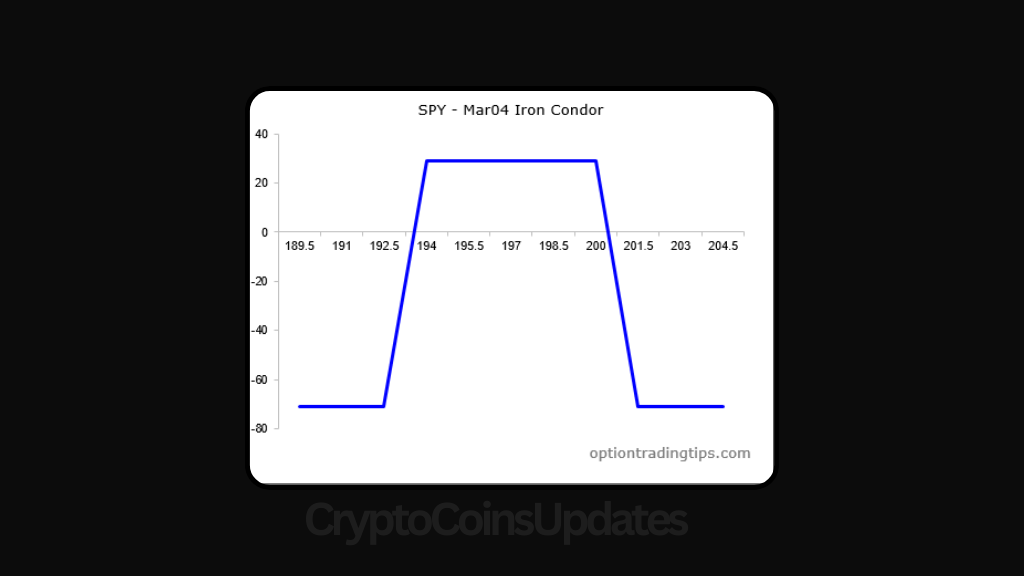

Definition and Purpose

The iron condor strategy aims to profit from stable or sideways price movements in the underlying asset by selling both a call spread and a put spread simultaneously.

Components of an Iron Condor

An iron condor consists of four options contracts: a short call spread, a long call spread, a short put spread, and a long put spread.

Risk and Reward Profile

While the iron condor offers limited potential profit, it also comes with limited risk, making it an attractive strategy for traders seeking consistent returns with controlled downside exposure.

Market Analysis for Iron Condor Trading

Technical Analysis

Technical analysis involves analyzing price charts and technical indicators to identify potential trading opportunities and determine optimal entry and exit points for iron condor trades.

Fundamental Analysis

Fundamental analysis involves assessing the underlying asset’s fundamentals, such as earnings reports, economic data, and industry trends, to gauge its future price direction and inform iron condor trading decisions.

Market Volatility Considerations

Volatility plays a crucial role in iron condor trading, as higher volatility levels typically result in higher options premiums, potentially increasing the strategy’s profit potential but also its risk.

Setting Up an Iron Condor Trade on SPY

Selecting Expiration Dates

Traders must carefully choose expiration dates that align with their trading objectives and market outlook, considering factors such as time decay and upcoming events that may impact volatility.

Choosing Strike Prices

Strike prices should be selected based on the trader’s desired risk-reward profile and market expectations, with consideration given to the underlying asset’s current price level and expected price range.

Calculating Potential Profit and Loss

Traders can use options pricing models and risk management tools to calculate the potential profit and loss of an iron condor trade before executing it, helping them assess its viability and manage risk effectively.

Managing Risk in Iron Condor Trading

Stop-loss Orders

Implementing stop-loss orders can help traders limit losses and protect their capital in case the market moves against their iron condor positions beyond predefined thresholds.

Adjustment Strategies

Traders may employ adjustment strategies, such as rolling the position or adding wings to the condor, to adapt to changing market conditions and minimize losses or enhance profits.

Portfolio Allocation

Proper portfolio allocation and position sizing are essential for managing risk in iron condor trading, as traders should avoid overexposure to any single trade or asset class.

Common Mistakes to Avoid

Overleveraging

Overleveraging can magnify losses and increase the risk of ruin, so traders should be mindful of their position sizes and avoid taking on excessive leverage when trading iron condors.

Ignoring Market Trends

Ignoring prevailing market trends and trading against the prevailing direction can lead to losses, as the iron condor strategy can be less effective in strongly trending markets. Traders should align their iron condor positions with the broader market trend to increase the strategy’s chances of success.

Case Studies and Examples

Successful Iron Condor Trades

Examining real-world examples of successful iron condor trades can provide valuable insights into the strategy’s implementation and its potential for generating consistent profits.

Failed Iron Condor Trades

Analyzing failed iron condor trades can help traders understand common pitfalls and mistakes to avoid, such as inadequate risk management or misjudging market conditions.

Lessons Learned

Reflecting on both successful and unsuccessful iron condor trades can help traders refine their strategies, improve their decision-making processes, and enhance their overall trading performance.

Advanced Iron Condor Techniques

Delta-Neutral Iron Condors

Delta-neutral iron condors involve adjusting the position’s delta to neutralize directional risk, allowing traders to profit from changes in volatility while minimizing exposure to price movements.

Calendar Iron Condors

Calendar iron condors involve selling near-term options contracts and buying longer-term options contracts to capitalize on time decay while maintaining a neutral market outlook.

Iron Condor with Weekly Options

Trading iron condors using weekly options contracts allows traders to take advantage of shorter expiration periods and potentially higher premiums, but it also entails increased risk due to accelerated time decay.

Conclusion and Final Thoughts

In conclusion, the iron condor strategy offers options traders a versatile approach to generating consistent returns in various market conditions, particularly in sideways or range-bound markets. By carefully selecting strike prices, managing risk effectively, and continuously refining their trading approach, traders can harness the power of iron condors to achieve their financial goals.